The Dubai International Financial Centre (DIFC) is a leading world-class business and lifestyle destination in the Middle East, Africa, and South Asia (MEASA) region. DIFC has a close to 20-year track record of facilitating trade and investment flows across MEASA. The region comprises 72 countries with a combined population of around three billion people and a nominal GDP of approximately USD 8 trillion. The centre offers a wide range of opportunities for setting up operating, holding, and tech companies for those who are focusing on business success. Among those, the revised regulation for Prescribed Companies is now attracting entities with its peculiarities.

DIFC introduced the Prescribed Company Regulations to supersede and broaden the scope of the previous regulations, the Special Purpose Company Regulations (SPC) and the Intermediary Special Purpose Vehicle Regime (ISPVR) in 2019. As a result of the enactment of the DIFC Prescribed Company Regulations, all Special Purpose Companies under the SPC Regulations were reclassified as Prescribed Companies. A key feature of this new regulation is its flexibility, fostering a business-friendly environment that promotes efficiency in time and cost savings for companies operating within the DIFC.

On July 15th, 2024, DIFC enacted a key amendment in the existing PC Regulations which significantly expand and simplify the current regime in the DIFC. The changes ensure that the companies are used as true holding company vehicles, rather than operational entities.

Now, what exactly is the Prescribed Company?

What is a Prescribed Company in the DIFC?

A Prescribed Company in the DIFC is a private company established under the DIFC Prescribed Company Regulations. It can be set up by a Qualifying Applicant or for a Qualifying Purpose. Qualifying Applicants include DIFC-registered entities, affiliates of such entities, shareholders, ultimate beneficial owners controlling a DIFC-registered entity, authorized firms, funds, UAE government entities, or family-operated businesses.

New PC Regulations Unveiled!

Effective from July 15, 2024, the DIFC has introduced significant updates to its PC Regulations. One among them is the expansion of the eligibility criteria for Prescribed Companies. Previously, eligibility was restricted to specific types of entities (qualifying applicants) and activities (qualifying purposes).

To incorporate or continue a Prescribed Company in the DIFC, applicants must now satisfy one of the following criteria:

1. The Prescribed Company is controlled by one or more:

a) GCC Persons.

b) Registered Persons.

c) Authorized Firms.

2. The Prescribed Company is established or continued in the DIFC for the purpose of holding legal title to, or controlling, one or more GCC Registrable Assets.

3. The proposed Prescribed Company is established or continued in the DIFC for a Qualifying Purpose; or

4. The Prescribed Company established or continued in the DIFC has a director appointed from a DFSA-registered Corporate Service Provider

How Does a CSP Facilitate the Establishment of a Prescribed Company?

Any individual or corporate entity that does not qualify for a Prescribed Company under the qualifying requirements can still establish one, regardless of their country of residence. This is possible if the PC appoints a director who is an employee of a DFSA-regulated CSP. This CSP must also have an agreement with the DIFC Registrar of Companies to undertake specific compliance and AML functions on behalf of the PC.

Key Changes from the Old PC Regime

Previously, the PC regime restricted eligibility to entities with a strong DIFC nexus or those involved in specific qualifying activities, limiting the product’s appeal to the existing DIFC client base. The new regulations have significantly expanded the eligibility criteria, allowing for the formation of PCs under broader circumstances.

DIFC believes these changes will expand the appeal of this vehicle to a global investor base while maintaining necessary ties to the DIFC and GCC. To accommodate potential increased demand, DIFC is enhancing its AML procedures and risk management framework.

What Happens to Existing PCs That Fall Outside the New Regime?

Existing PCs will be restricted to their designated purpose as holding companies, prohibiting employment. This ensures their function as pure holding vehicles. PCs that no longer align with these criteria will benefit from transitional arrangements and a new commercial package offering continued licensing advantages similar to the previous regime. The package, named “Active Enterprise,” provides flexible options and reduced fees for qualifying applicants seeking alternative structures with the option to have employees.

Active Enterprise is a private company that can be established by a Qualifying Applicant. This structure is suitable for Holding Companies, Managing Offices, and Proprietary Investment activities across various sectors such as real estate, agricultural enterprises, management, and healthcare. The package has:

- Option to have employees: In the case that Active Enterprise or its affiliate has an office in the DIFC.

- Reduced licensing fees: USD 100 Application Fee (one time) and an annual commercial license fee of USD 1000 (Data protection fees USD 750 – if applicable).

- Flexible registered address: An Active Enterprise can have its own DIFC office space, co-working desk, share office space with its DIFC affiliate or, if the entity has no employees, use an appointed CSP’s registered address in DIFC.

- Common law jurisdiction with independent DIFC Courts

- Quick and easy, fully digital registration process: In-principal approval may be granted within three business days from the application submission.

- No attestation is required for corporate documents.

- Globally competitive and attractive tax regime.

- Zero currency restrictions and 100% foreign ownership.

- Zero restrictions on capital repatriation.

Why a Prescribed Company in DIFC?

There are several compelling reasons to opt for a Prescribed Company setup in DIFC:

- Low-Cost Setup and Maintenance Costs: The cost of setting up and maintaining a DIFC Prescribed Company is considerably lower compared to a standard DIFC operational license.

- Flexible Office Requirements: Prescribed Companies enjoy flexibility in office arrangements, allowing them to have their own DIFC office space, share space with individuals fulfilling qualifying requirements, or appoint a CSP for registered address services.

- Favorable Tax Environment: The company benefits from 0% taxation on dividends and qualifying income, along with access to DIFC’s comprehensive network of double taxation treaties.

- Legal Certainty and Efficiency: Operating within the DIFC’s English common law-based legal system, the company enjoys greater flexibility and innovation compared to other UAE free zones.

- Fast-Track Application Process: Prescribed Companies benefit from an expedited application process, being exempt from auditing and filing accounts with the DIFC Registrar of Companies.

Exemptions for Crowdfunding and Structured Financing Activities

A Prescribed Company in DIFC with a crowdfunding structure enjoys several exemptions, further highlighting the benefits of a Prescribed Company in DIFC.

- Crowdfunding Exemptions: A PC with a crowdfunding structure is exempt from the Companies Law requirement to have no more than 50 shareholders. Additionally, if its annual turnover is no more than USD 5 million, it is exempt from the need to prepare and file audited accounts, even if it has more than 20 shareholders.

- Structured Financing Exemptions: PCs involved in structured financing are exempt from filing and auditing requirements. Furthermore, PCs issuing bonds or sukuk to the public can bypass the usual prohibition against private companies making public offers and the 50-shareholder limit.

Reduced Fees and Cost Efficiency

The PC regime in the DIFC offers a low-cost structure with significantly reduced fees. The application fee is a one-time payment of USD 100, and the annual license fee is USD 1,000. This cost efficiency, combined with the flexibility and exemptions provided by the PC structure, makes it a highly attractive option for businesses seeking a cost-effective entry into the DIFC.

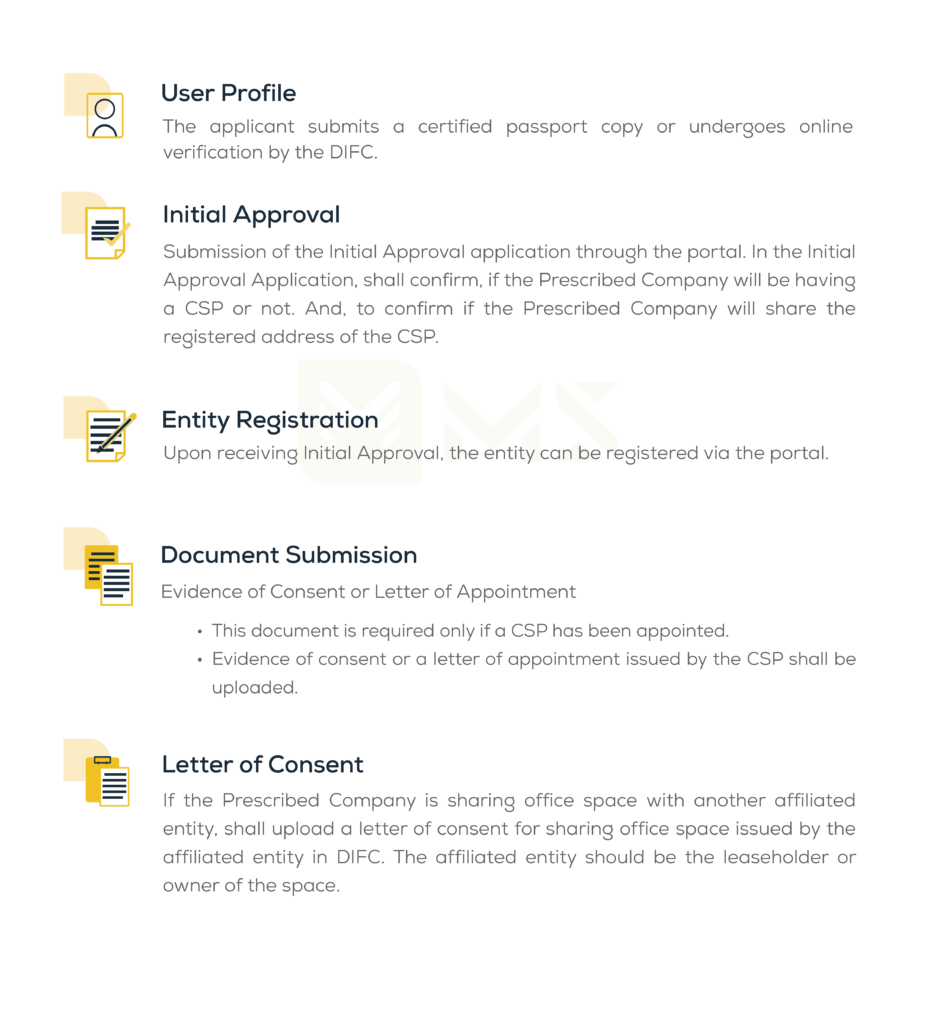

Application Process for the set up of Prescribed Company in the DIFC

DIFC is Ready. Are You?

With the introduction of this new PC regime, DIFC aims to balance requiring substantive economic activity and providing access to flexible corporate structures for legitimate purposes. In the new UAE Corporate Tax era, which addresses substance concerns, the DIFC believes that expanding the PC regime is timely and beneficial.

Disclaimer:

The information provided in this article is for general informational purposes only and should not be

considered legal or professional advice. As always, we recommend that you consult with your legal/incorporation,

financial and/or tax advisors